Put Option

put = Option TO SELL (put it on the market) at a certain price. So, if the price goes down, but you still have the right to sell it at a higher price, then you have a valuable asset. You dont even need to already own the asset (stock)... if you have the right to sell the stock at a price of $100 dollars, but the market price falls to $75, then you can make $25. The put option gives you the right to "put" the asset up for sale at a certain price. To make money, you just need to buy low (on the open market), and then sell high (as your contractually allowed to do with the put option). Note, however, that the put option has 0 value if the value of the asset goes above the strike price. How do you know the value of the option? Its easy...if the strike price is $100 and the market price drops to $75 then you are "in the money", and have a value of $25.

Because the value of the put option rises as the underlying asset price falls, you see the graph as a "reverse hockey stick" shape (below).

On the other hand, if you had sold the put contract to someone else, then you would stand to loose money if the price of the underlying asset were to fall below the strike price. This would have a graph as a mirror image as follows:

Foreign exchange Options

Gives you the right to purchase / sell a currency at a certain price (from now, up till an expiration date). You have the right to purchase (or sell), but you dont have to. On the other hand, the other party to this "options" contract is required to buy (or sell) if you ask them to. These "options" can be bought and sold in a market (much like the "futures" can).

- Examples: If you expect to make a payment in the next 3 months, then you might want to purchase a "call option", which will give you the right to buy foreign currency (for you to make your payment) at a specified price. This way, you will be protected if the currency FX rate suddenly changes. At least you will be able to purchase the foreign currency at that price, and to make your payment as needed.

- If, on the other hand, you are waiting for a foreign currency payment to arrive, and you are afraid that a sudden change in the FX rate might decrease the amount of money you will receive, you might want to purchase a "put option" which will give you the right to sell the foreign currency at a certain price (over the specified time period).

Put Options - general info

A put option (sometimes simply called a "put") is a financial contract between two parties, the buyer and the writer (seller) of the option. The put allows the buyer the right but not the obligation to sell a commodity or financial instrument (the underlying instrument) to the writer (seller) of the option at a certain time for a certain price (the strike price). The writer (seller) has the obligation to purchase the underlying asset at that strike price, if the buyer exercises the option.

Note that the writer of the option is agreeing to buy the underlying asset if the buyer exercises the option. In exchange for having this option, the buyer pays the writer (seller) a fee (the premium). (Note: Although option writers are frequently referred to as sellers, because they initially sell the option that they create, thus taking a short position in the option, they are not the only sellers. An option holder can also sell his long position in the option. However, the difference between the two sellers is that the option writer takes on the legal obligation to buy the underlying asset at the strike price, whereas the option holder is merely selling his long position, and is not contractually obligated by the sold option.)

Exact specifications may differ depending on option style. A European put option allows the holder to exercise the put option for a short period of time right before expiration. An American put option allows exercise at any time during the life of the option.

The most widely-known put option is for stock in a particular company. However, options are traded on many other assets: financial - such as interest rates (see interest rate floor) - and physical, such as gold or crude oil.

The put buyer either believes it's likely the price of the underlying asset will fall by the exercise date, or hopes to protect a long position in the asset. The advantage of buying a put over shorting the asset is that the risk is limited to the premium. The put writer does not believe the price of the underlying security is likely to fall. The writer sells the put to collect the premium. Puts can also be used to limit portfolio risk, and may be part of an option spread.

Wikipedia Definition

A put option (sometimes simply called a "put") is a financial contract between two parties, the buyer and the writer (seller) of the option. The put allows the buyer the right but not the obligation to sell a commodity or financial instrument (the underlying instrument) to the writer (seller) of the option at a certain time for a certain price (the strike price). The writer (seller) has the obligation to purchase the underlying asset at that strike price, if the buyer exercises the option.

Note that the writer of the option is agreeing to buy the underlying asset if the buyer exercises the option. In exchange for having this option, the buyer pays the writer (seller) a fee (the premium). (Note: Although option writers are frequently referred to as sellers, because they initially sell the option that they create, thus taking a long position in the option, they are not the only sellers. An option holder can also sell his short position in the option. However, the difference between the two sellers is that the option writer takes on the legal obligation to buy the underlying asset at the strike price, whereas the option holder is merely selling his short position, and is not contractually obligated by the sold option.)

Example of a put option on a stock

Buy a Put: Buyer thinks price of a stock will decrease.

Pay a premium which buyer will never get back.

The buyer has the right to sell the stock

at strike price.

Write a put: Writer receives a premium.

If buyer exercises the option,

writer will buy the stock at strike price.

If buyer does not exercise the option,

writer's profit is premium.

- I purchase a put contract to sell 100 shares of XYZ Corp. for 50 each. The current price is 55 per share, and I pay a premium of 5 per share. If the price of XYZ stock falls to 40 per share right before expiration, then I can exercise my put by buying 100 shares for 4,000, then selling it to a put writer for 5,000. My total profit would equal 500 (5,000 from put writer - 4,000 for buying the stock - 500 for buying the put contract of 100 shares at 5 per share, excluding commissions).

- If, however, the share price never drops below the strike price (in this case, 50), then I would not exercise the option. (Why sell a stock to someone at 50, the strike price, if it would cost me more than that to buy it?) My option would be worthless and I would have lost my whole investment, the fee (premium) for the option contract, 500 (5 per share, 100 shares per contract). My total loss is limited to the cost of the put premium plus the sales commission to buy it.

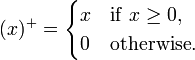

This example illustrates that the put option has positive monetary value when the underlying instrument has a spot price (S) below the strike price (K). Since the option will not be exercised unless it is "in-the-money", the payoff for a put option is

- max[(K − S) ; 0] or formally, (K − S) +

- where :

Prior to exercise, the option value, and therefore price, varies with the underlying price and with time. The put price must reflect the "likelihood" or chance of the option "finishing in-the-money". The price should thus be higher with more time to expiry, and with a more volatile underlying instrument. The science of determining this value is the central tenet of financial mathematics. The most common method is to use the Black-Scholes formula. Whatever the formula used, the buyer and seller must agree on this value initially.

Kookyplan Links

External links

- Long Put Option, OptionTradingTips.com

- Put Option Calculator, option-price.com

- Disk Lectures, Options I audio lecture with slideshow

- BAE Exercising Its 'Put Option' Re: Airbus

Wikipedia Links

Options

| Derivatives market | |

|---|---|

| Derivative (finance) | |

| Options |

Terms: Strike price · Expiration · Open interest · Pin risk Vanilla options: Option styles · Call · Put · Warrants · Fixed income · Employee stock option · FX Exotic options: Asian · Lookback · Barrier · Binary · Swaption · Mountain range Options strategies: Covered call · Naked put · Collar · Straddle · Strangle · Butterfly Options spreads: Bull spread · Bear spread · Calendar spread · Vertical spread · Debit spread · Credit spread Valuation of options: Moneyness · Option time value · Put-call parity · Black-Scholes · Black · Binomial |

| Swaps | |

| Other derivatives | |