The US Dollar

see also: Currency , foreign currency trading

In 1995, over US $380 billion were in circulation, two-thirds of which was outside the United States. By 2005, that figure had doubled to nearly $760 billion, with an estimated half to two-thirds being held overseas, representing an annual growth rate of about 7.6%. However, as of December 2006, the dollar was surpassed by the euro in terms of combined value of cash in circulation. The value of euro notes in circulation had risen to more than €610 billion, equivalent to US$802 billion at the exchange rates at the time.

Table of Contents

Measuring the strength /weakness of the dollar:

How strong is the dollar vs. a "basket" of currencies? See actual quotes .DXY (see link here)

ICE’s Dollar Index, which tracks the greenback against the euro, the yen, the pound, the Canadian dollar, the franc and Sweden’s krona

see our discussion on Weak US dollar and Strong US dollar

Effect of the Credit Crisis:

US debt as an EXPORT...one interesting one is the fact that US financial products (debt, repackaged as securities) has been one of the main US exports.

Prior to 2007, the structured finance innovations from the US were one of the major exports. But, with the confidence of the foreign bankers shaken after the crisis, exports of products such as "securitized mortgages" became a difficult sell. This accounted for a large portion of the depreciation of the US dollar (leading up till Sept '08...when investors ran for "security" of US Treasuries)...

Its interesting that one of the US 's biggest exports in recent years has been the financial innovations such as SIV's, collatoralized debt, and asset backed securities. European banks have been great customers. But, since the housing crisis of 2007, and the ensuing credit crunch, the foreign banks are no longer hungry buyers of US financial innovations. Rather, they are staying away...

will they come back? If not...what will happen to the dollar after "flight-to-Treasuries" passes?

see also: financial innovations

Should the US Dollar depreciate:

maybe, but against what?

if you say the dollar will weaken...i wonder which currency will strengthen?

- the Euro? (it has its own fundamental weakness with Eastern Europe, divergent credit default spreads, differing responses to the crisis, fiscal stimulus, etc...all of which might rip the Union apart)

- the JPN Yen? how much more can it appreciate before intervention?

- the Pound? Yikes, I wouldnt bet on british currency right now as its in free fall, and without sturctural support...

- whats left? Chinese Yuan? not likely the Chinese will allow it to appreciate...

- oil exporters? nope. free fall...

- commodity exporters? yikes..not there either...

so, the real question isnt whether or not the US dollar is fundamentally weak (which it is), but whether or not it is slightly stronger than all of the others...which it is...Perhaps you could buy gold if you didnt know which currency the dollar wil weaken against...its a good hedge if you think the dollar will fall, but not sure against what....

My friend, Duncan put it this way..."Right now, in the comparative world known as FX markets, the USD has every reason to be strong. Our Fed and gov't have shown the world that we fully intend to solve this problem, no matter how much it may cost (long-term USD-negative, but good right now), while other countries are sitting around, cutting interest rates, and dealing out some pathetic little bailout packages.

Amongst the three "safe haven" currencies, USD, CHF, JPY, the USD is the ONLY ONE that has not had any gov't annoucements or threats of intervention to push it lower. Both CHF and JPY have not only made announcements hinting at this, but have every intention of going through with these actions...because both nations are heavily dependent on exports.

Taking a look at the other G10 currencies (more or less, a list of hard currencies), GBP and EUR are simply a mess with deteriorating sovereign credit conditions either currently present or mounting, CAD is a commodity currency, which depends heavily on US demand for oil...stagnant at best. AUD and NZD are commodity currencies based off of Asian aggregate demand...not doing too well. NOK and SEK are also commodity currencies, especially NOK...oil isn't exactly booming and the Baltics/Scandinavians are facing some harsh economic realities. EMs are taking a beating and the bigger currencies, RUB (trash), MXN (depends on US demand and oil), BRL (fundamentals looking to be getting much worse), CNY (controlled, but a free-float would be HUGE...but not in their best interest right now), INR (aggregate economic conditions are bad and declining), ZAR (commodities taking a beating and an election in a few months)..."

International use

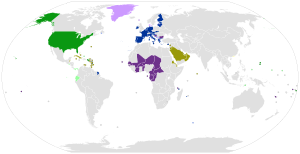

Comparison of worldwide use of the U.S. dollar and the euro

The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum (the latter sometimes called petrocurrency). Even foreign companies with little direct presence in the United States, such as the European company Airbus, list and sell their products in dollars, although some argue this is attributed to the aerospace market being dominated by American companies. At the present time, the U.S. dollar remains the world's foremost reserve currency, primarily held in $100 denominations. The majority of U.S. notes are actually held outside the United States, known as eurodollars (not to be confused with the euro) regardless of the location.

for more, see Wikipedia

Dollarization and fixed exchange rates

Other nations besides the United States use the U.S. dollar as their official currency, a process known as official dollarization. For instance, Panama has been using the dollar alongside the Panamanian balboa as the legal tender since 1904 with a rate of change of 1:1. Ecuador (2000), El Salvador (2001), and East Timor (2000) all adopted the currency independently. The former members of the U.S.-administered Trust Territory of the Pacific Islands, which included Palau, the Federated States of Micronesia, and the Marshall Islands, chose not to issue their own currency after becoming independent, having all used the U.S. dollar since 1944. Two British dependencies also use the U.S. dollar: the British Virgin Islands (1959) and Turks and Caicos Islands (1973)

Some other countries link their currency to U.S. dollar at a fixed exchange rate. The local currencies of Bermuda and the Bahamas can be freely exchanged at a 1:1 ratio for USD. Argentina used a fixed 1:1 exchange rate (Currency) between the Argentine peso and the U.S. dollar from 1991 until 2002. The currencies of Barbados and Belize are similarly convertible at an approximate 2:1 ratio. In Lebanon, one dollar is equal to 1500 Lebanese pound, and is used interchangeably with local currency as de facto legal tender. The exchange rate between the Hong Kong dollar and the United States dollar has also been linked since 1983 at HK$7.8/USD, and pataca of Macau, pegged to Hong Kong dollar at MOP1.03/HKD, indirectly linked to the U.S. dollar at roughly MOP8/USD. Several oil-producing Gulf Arab countries, including Saudi Arabia, peg their currencies to the dollar, since the dollar is the currency used in the international oil trade.

The renminbi used by the People's Republic of China was informally and controversially pegged to the dollar in the mid-1990s at ¥8.28/USD. Likewise, Malaysia pegged its ringgit at RM3.8/USD in 1997. On July 21, 2005 both countries removed their pegs and adopted managed floats against a basket of currencies. Kuwait did likewise on May 20, 2007, and Syria did likewise in July 2007.

Belarus, on the other hand, will tie its currency, the Belarusian ruble, with the U.S. dollar in 2008. In some countries, such as Peru, although USD is not officially regarded as a legal tender, it is commonly accepted. In Mexico's border area and major touristical zones, it is accepted as if it was a second legal currency. In Cambodia, the USD circulates freely, or even preferred over the Cambodian riel. Amounts of one dollar or more are given in dollars, while the riel serves as a subunit.

More about the Dollar

The dollar's value refers to the purchasing power of the dollar versus other currencies, or the exchange rate between the two currencies. When the dollar is strong, foreign goods are relatively less expensive.

This can benefit businesses that import raw materials or manufactured goods into the United states, such as Wal-Mart. A weakening dollar benefits companies with foreign competitors, such as Ford, as their competitors' goods become more expensive. A weakening dollar can also lead to rising interest rates, as investors require higher rates to compensate for the added Currency risk. Higher interest rates, in turn, have significant consequences for the housing market and business investment in general. A strong dollar means lower oil prices, as the US purchase much of its oil abroad. As the dollar weakens oil producers charge more to protect their margins.

Factors affecting the dollar

Trade Deficit

A trade deficit occurs when a country imports more than it exports. This leads to a net outflow of a country's currency. Countries on the other side of the transaction will typically sell the importing country's currency on the open market. As supply of the country's currency increases in the global market the currency depreciates. As a net importer, the US has seen its trade deficit grow rapidly over the last decade. In 2006 the US had a record deficit of 765 billion dollars.

Budget Deficit

When a country's government spends more than it earns from taxes or other sources of revenues, it is forced to borrow from its citizens and/or from foreign entities. As a country's debt load increases, the value of its currency may decrease as result of fears within the international community over its ability to repay the debt. Currently, the US is the world's largest debtor with approximately 9 trillion dollars in debt held by the public (includes intergovernmental and debt owed by States, corporations and individuals). Over half of the debt held by the public is held by foriegners.

A Brief History:

The gold standard was the way in which the international monetary system maintained parities until the 1930’s (with a notable interruption during WWI and the years that followed it). Later, at the end of WWII, more than 40 countries signed on to the Bretton Woods agreement, which established a fixed exchange rate system between most of the major world economies.

The accord stipulated that the undersigned fixed the value of their currencies in relation to the US Dollar (USD), and that the dollar would be convertible to gold at the fixed price of U$35/ozt. The Bretton Woods lasted until 1971, when President Richard Nixon suspended the USD convertibility to gold and unilaterally changed the USD parity with other international currencies. From 1973 to 1999, the USD, the Japanese Yen and the European currencies operated a “dirty float” exchange system, that is to say the currencies were allowed to move in accordance with market forces but the central bank of each country would intervene to move the exchange rate in one or another direction. In general, exchange rates between the European currencies stayed inside a tight band from 1973. For example the German Mark and the French Franc freely floated with respect to the USD, though they stayed within a tight band between each other most of the time by virtue of an agreement known as the European Monetary System.

In January 1999, eleven countries adopted the same currency, the Euro, issued and administered by the European Central Bank (ECB), which floats against the dollar in the same way as the various European currencies did up to 1999. Today, thirteen countries have adopted the Euro, with two more due to join in 2008. After Bretton Woods fell apart, the USD remained the focus of the international monetary system, and evidence to support that abounds. In 2000, more than 70% of international reserves were in USD. However, that proportion has fallen every year, reaching a bit under 65% in 2007. It is the Euro which has gained from the reduction of dollar holdings: Euro assets have gone from a little over 18% of world reserves to nearly 26% in 2007. The British Pound has also gained, to 4.7% of total reserves in 2007.

Links

Historical exchange rates

| Currency units per U.S. dollar |

|---|

| |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

| Euro |

0.9387 |

1.0832 |

1.1171 |

1.0578 |

0.8833 |

0.8040 |

0.8033 |

0.7960 |

| Japanese yen |

113.73 |

107.80 |

121.57 |

125.22 |

115.94 |

108.15 |

110.11 |

116.31 |

| Pound sterling |

0.6184 |

0.6598 |

0.6946 |

0.6656 |

0.6117 |

0.5456 |

0.5493 |

0.5425 |

| Chinese Renminbi |

8.2781 |

8.2784 |

8.2770 |

8.2771 |

8.2772 |

8.2768 |

8.1936 |

7.9723 |

| Canadian dollar |

1.4858 |

1.4855 |

1.5487 |

1.5704 |

1.4008 |

1.3017 |

1.2115 |

1.1340 |

| Mexican peso |

9.553 |

9.459 |

9.337 |

9.663 |

10.793 |

11.290 |

10.894 |

10.906 |

|

Current USD exchange rates

Books about FX trading from Amazon.com

Comments (0)

You don't have permission to comment on this page.